UBL Ameen Housing Finance – Complete Guide to UBL’s Islamic Home Financing

UBL Ameen Housing Finance

Home is all and sundry dream. To help Pakistanis fulfill this dream below Shariah-compliant terms, UBL offers UBL Ameen Housing Finance through its Islamic banking wing, commonly proprietary under “UBL Ameen” (for example, “Mera Pakistan Mera Ghar”). In this guide, you will find all you need: eligibility, financing amounts, tenure, application process, required leaflets, benefits, difficulties, and tips. After reading this, you won’t need to look away. UBL Ameen Housing Finance – Complete Guide to UBL’s Islamic Home Financing| Field | Details |

|---|---|

| Program Name | UBL Ameen Housing Finance (also “Mera Pakistan Mera Ghar”) |

| Start / Launch | Already active (current as of 2025) |

| Maximum Financing / Limits | Up to PKR 50 million (for certain products) |

| Tenure / Duration | 3 to 20 years |

| Method of Application | Branch (Islamic / UBL Ameen branch), online via UBL digital channels |

What Is UBL Ameen Housing Finance?

UBL Ameen Housing Money (also sometimes mentioned as Mera Pakistan Mera Ghar) is a Shariah-compliant home financing scheme obtainable by UBL’s Islamic investment division. It allows clienteles to:

- Buy a new or existing house or apartment

- Construct a home on a plot

- Renovate or repair an existing home

- Equity / home improvement financing (making improvements, extension)

Because it is fully Islamic / interest-free (riba-free) and operates under Diminishing Musharakah or similar Shariah assemblies, it’s a favored choice for those who want home-based money translation to Islamic standards. More Read: BISE Bahawalpur Board 11th Result 2025

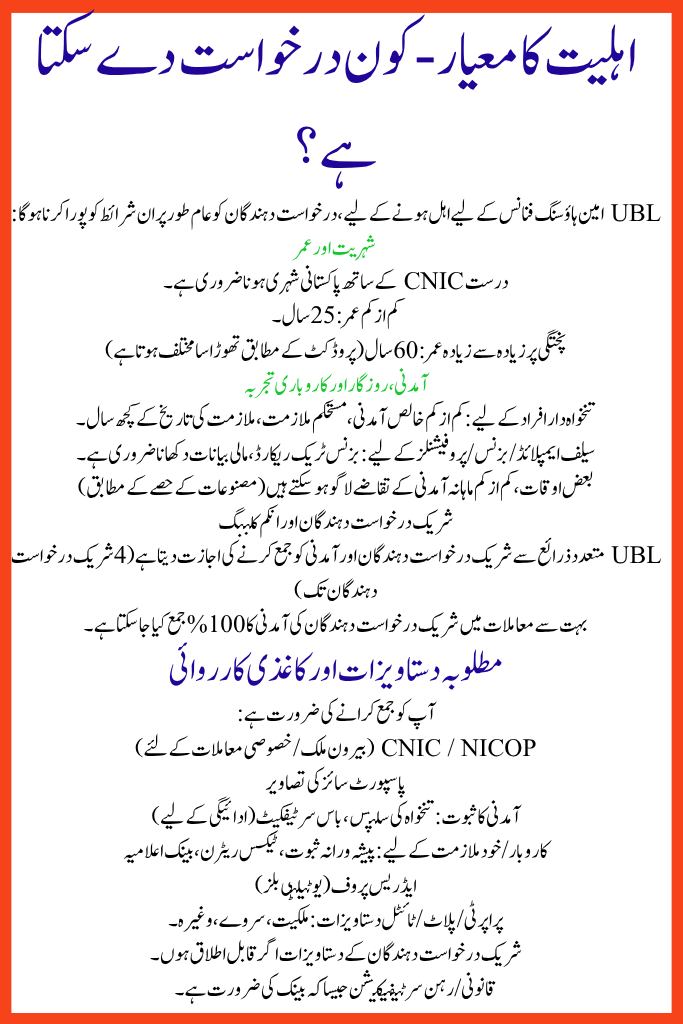

Eligibility Criteria – Who Can Apply?

To qualify for UBL Ameen Housing Finance, applicants typically must meet these conditions:

Citizenship & Age

- Must be a Pakistani citizen with valid CNIC.

- Minimum age: 25 years.

- Maximum age at maturity: 60 years (varies slightly as per product)

Income, Employment & Business Experience

- For salaried individuals: minimum net income, stable job, some years of employment history.

- For self-employed / business / professionals: must show business track record, financial statements.

- Sometimes, minimum monthly income requirements may apply (as per product segment)

Co-Applicants & Income Clubbing

- UBL allows co-applicants and income clubbing from multiple sources (up to 4 co-applicants)

- 100% of co-applicant income may be clubbed in many cases.

Financing Amounts & Repayment Period

Minimum & Maximum Financing

- Minimum financing: PKR 1,000,000 (1 million) for many product categories.

- Maximum financing: Up to PKR 50,000,000 (50 million) for purchase / construction categories.

- For renovation / equity, maximum financing often limited to 30% of appraised value or as per policy.

Tenure / Duration

- Minimum repayment term: 3 years

- Maximum term: 20 years

- Some variants offer 10, 15, 20 year tenures.

Pricing / Profit Rate (Markup) & Early Settlement

- The pricing is linked with 1 Year KIBOR + margin in many cases.

- For early settlement / buyout, certain percentage charges apply depending on year.

- Partial pre-payment often allowed once per year, with minimum amounts (e.g. PKR 50,000) up to a limit (e.g. 6 months’ installments)

More Read: BISE Sahiwal Board 11th Class Result 2025 Out Soon

How to Apply – Step by Step

Offline / Branch Application

- Visit a UBL Ameen / Islamic Banking branch near you.

- Ask for housing finance / home loan (UBL Ameen) application form.

- Fill in the form along with required documents (list given below).

- Submit to branch; the bank will verify your income, credit history, property documents.

- Upon approval, sign agreements and the funds are disbursed.

Online / Digital Application

- UBL’s digital banking platform and UBL Ameen network may permit online portion submission in some cities.

- However, certain in-person verification (signatures, property inspections) will still be needed.

Required Documents & Paperwork

You need to submit:

- CNIC / NICOP (for overseas / special cases)

- Passport size photographs

- Proof of income: salary slips, boss certificate (for paid)

- For business / self-employed: occupational proof, tax returns, bank declarations

- Address proof (utility bills)

- Property / plot / title documents: ownership, survey, etc.

- Co-applicant documents if applicable

- Legal / mortgage certification as required by the bank

More Read: Punjab Solar Panel Scheme 2025

Benefits & Possible Drawbacks

Key Benefits

- 100% Shariah-compliant (interest-free structure)

- Long tenures (up to 20 years) for manageable installments

- Suitable for purchase, construction, renovation under one scheme

- Wide reach via UBL Ameen / Islamic branches nationwide

- Government subsidies / low cost housing programs may tie in (for low-income segments)

- Early settlement / partial payment options available (though with conditions)

Possible Drawbacks / Things to Consider

- Charges or penalties on early buyout / settlement in initial years

- Property valuation and appraisal risks

- If markup / profit rate is variable, payments may increase

- Incomplete or weak credit history may delay or deny approval

- Some expense expenses (legal, certification, processing) are borne by candidate

Tips for a Successful Application

- Maintain good credit history and clear banking statements

- Ensure your income is stable and documented

- Use co-applicants to boost combined income if needed

- Get your property documentation in order before applying

- Visit a UBL Ameen branch and counsel with their Islamic finance officers

- Carefully read the terms for early settlement, margin, adjustments

Final Thoughts

UBL Ameen Housing Finance proposals a robust, Shariah-compliant trail for Pakistanis to own, build, or renew homes under Islamic finance principles. With flexible tenures, proper certification, and transparent terms, it can be a strong option for many. Always confirm exact footings at your local UBL Ameen / Islamic branch, as circumstances can vary by city, income section, or creation variant.

More Read: How To Complete Registration in Aaghosh Program