Breaking News Gold Prices Decreases In Pakistan – Market Sees Sharp Drop Amid Global Trends

Gold Prices Decreases In Pakistan

Gold Prices Decreases In Pakistan have recently shown a sharp downward correction, reflecting a mix of global and domestic market forces. After touching record-high levels earlier this year, the precious metal is now stabilizing as the international market adjusts to a stronger U.S. dollar, shifting investor sentiment, and evolving inflation expectations.As of early November 2025, the rate for 24-karat gold in Pakistan stands around Rs 420,500 per tola, while 22-karat gold is priced near Rs 385,400 per tola. This decline comes just weeks after gold crossed Rs 430,000 per tola in major cities.

Understanding the Drop in Gold Prices in Pakistan

The fall in domestic gold prices Decreases In Pakistan mirrors global corrections in the international bullion market. Following months of steady gains, investors are now reassessing positions amid expectations that global interest rates could remain higher for longer.Locally, the market is also responding to factors like the Pakistani rupee’s performance against the U.S. dollar, import costs, and seasonal consumer demand. As gold prices ease, jewellers are reporting slightly higher footfall, with many buyers considering this dip an opportunity to purchase ahead of the winter wedding season.

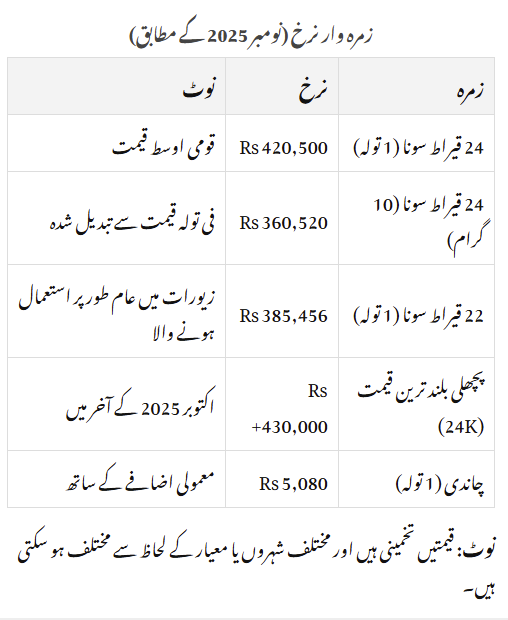

Key Details: Current Gold Prices and Market Snapshot

| Category | Rate (as of Nov 2025) | Notes |

| 24 K Gold (1 Tola) | Rs 420,500 | Average national rate |

| 24 K Gold (10 Grams) | Rs 360,520 | Converted from per-tola rate |

| 22 K Gold (1 Tola) | Rs 385,456 | Commonly used in jewellery |

| Previous Peak (24 K) | Rs 430,000+ | Late Oct 2025 high |

| Silver (1 Tola) | Rs 5,080 | Trending slightly upward |

| Purchase Eligibility | Open to all buyers | No restrictions; prices vary by city |

Rates are approximate and may differ by location, purity, and jeweller.

Global Factors Influencing Gold Prices

A major reason behind the current slide in gold prices is the persistent strength of the U.S. dollar. When the dollar appreciates, gold—priced globally in USD—becomes more expensive for foreign investors, reducing international demand.With inflation easing in major economies and central banks signaling a cautious approach to rate cuts, investors are rotating away from gold toward yield-bearing assets. High interest rates typically weaken gold’s appeal, as the metal does not generate interest or dividends.Gold’s role as a safe-haven asset often intensifies during periods of geopolitical tension or economic instability. In recent weeks, relative calm and improving global growth forecasts have reduced urgency for safe-haven buying, adding to downward price pressure.

Local Market Dynamics

In Pakistan, domestic gold rates are derived from international prices but are heavily influenced by local currency strength and import costs. The rupee’s moderate stability in recent months has helped limit large upward spikes in gold rates.Jewellers report that customer activity has improved slightly since prices dipped. Many individuals who postponed purchases earlier in the year are now returning to the market, especially ahead of the traditional wedding season when gold jewellery demand rises significantly.Still, despite the recent correction, current rates remain historically high compared with 2023 and early 2024 levels. Financial experts believe short-term relief could continue, but volatility is likely as global trends remain unpredictable.

Silver Prices Move in Tandem

Silver, too, has followed gold’s movement. The price of one tola of silver in Pakistan is currently hovering around Rs 5,080, after experiencing fluctuations earlier this month. Both metals are responding to similar global pressures, including currency strength, interest-rate expectations, and investor risk appetite.

Future Outlook: Will Gold Prices Continue to Fall?

Analysts remain divided on the direction of gold prices in the coming weeks. Some expect the correction phase to persist if the dollar remains strong and interest rates stay elevated. Others argue that gold could rebound soon if inflationary pressures resurface or geopolitical risks increase.Long-term, gold continues to be considered a reliable hedge against currency depreciation and inflation. For Pakistani investors, holding gold in physical or digital form remains an effective diversification strategy, even amid short-term fluctuations.

FAQs

Q1: Is now a good time to buy gold in Pakistan

If you’re buying gold for personal use, such as weddings or savings, the current dip offers a relatively favorable entry point. However, for investment purposes, it’s wise to monitor global market cues, as prices could fluctuate further in the short term.

Q2: Why are local gold prices different across cities?

Gold prices can vary slightly due to transportation costs, jeweller margins, and local demand. Major cities like Karachi, Lahore, and Islamabad usually display similar rates, while smaller markets may differ by a few hundred rupees per tola.

Q3: How does the dollar rate affect gold prices in Pakistan?

Gold is globally traded in U.S. dollars. When the dollar strengthens, it raises the local cost of gold imports in rupees, pushing prices higher. Conversely, when the rupee gains or the dollar weakens, local gold prices tend to ease.

Final Word

In summary, gold prices in Pakistan have eased to around Rs 420,500 per tola after touching historic highs just weeks earlier. The adjustment stems from a stronger dollar, stable inflation data, and cautious investor sentiment worldwide.For consumers, the current environment provides a brief window of relief and potential buying opportunity. Yet, as global uncertainty continues, the gold market is expected to remain volatile. Whether for investment or adornment, staying updated on daily rates and economic trends is essential for making informed decisions.